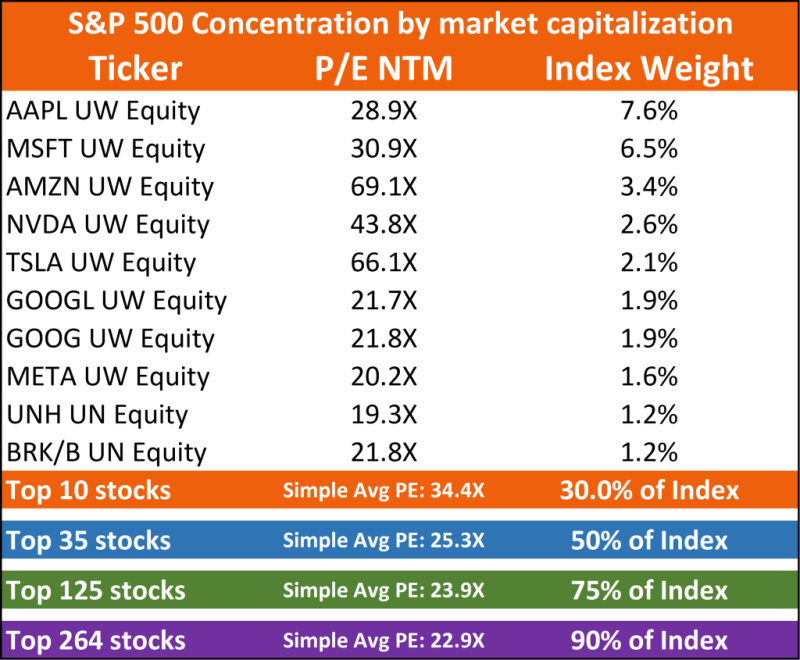

The big news of last week was that the S&P 500 has moved into what is technically bull market territory—defined as a 20% gain since its low on October 12th 2022. Unfortunately, the bulk of the index’s gains have come from a handful of heavyweight stocks that feature expensive valuations despite increased discount rates. If you look at the top 10 stocks in the S&P 500, the simple average forward P/E is 34X – that’s 50% higher than 90% of the index.

Weekly Sector Review

For the week ended Jun 9, 2023

Artificial Exuberance vs Artificial Intelligence

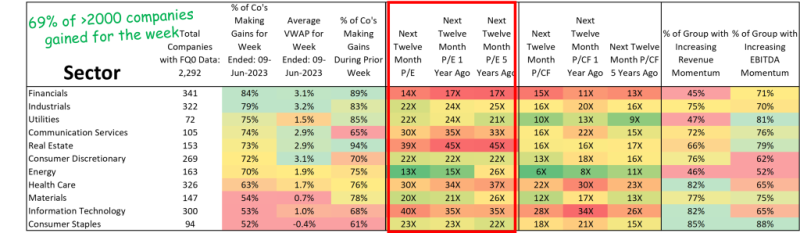

Looking at sectoral performance, valuations on an equal-weighted basis do not look cheap.

Using what we know to find opportunities

For all the concerns about valuations and concentration, there are some positives. First, there is a strong consensus that we are close to peak interest rates in the U.S. and Canada. Second, having lived through periods of investor mania, I believe we may be at the start of yet another one. In my short career, I have lived through: the Dotcom era of the late 1990s through the early 2000s, the made-in-Canada Income Trust fever of 2004-2006, the Cannabis Craze from 2014-2018, and most recently, the rise of ESG and its knock-on effect on valuations in the Oil and Gas industry. The new chapter about to be written has already been dubbed Artificial Exuberance (A.E.).

Some think this mania will be short-lived, but there is likely to be enough impact in terms of fear-inducing headlines and company hype that A.E. and A.I. will walk together for some time. In a battle of future-based fears, the less nebulous one is typically the one that wins. In terms of threats to humanity, A.I. as a job-stealer/killer of humanity has not gotten much airplay yet, but if it does, it could steal crucial mindshare from the current threat du jour of climate apocalypse. Even as fear grips Main Street, there could be benefits to Wall Street. For example, A.I. can easily be blamed for an uptick in unemployment coming naturally as a result of inflation fighting. The video games industry is already chirping about the risk of A.I.-based unemployment.

Hunting at the nexus of A.E. mania and a dovish Fed outlook

One of the benefits of human intelligence is the ability to imagine something and try to find it. Case in point: Gen Digital (GEN-NYSE). GEN is a provider of online safety solutions including Norton, Avast, LifeLock, and others. It competes within the Information Technology Sector and has a market capitalization of USD11 billion (all figures to follow are in USD). GEN provides real-time protection for personal computers and mobile devices and is a good candidate for early adoption of A.I.-based cybersecurity countermeasures to what are very likely to be A.I.-enhanced attack vectors.

For all that potential, GEN currently trades at a forward P/E multiple of less than 9X, while its median multiple over the past 9 years is 23X. On a discounted cash flow basis, I calculate that under a scenario of zero growth for the next 10 years the stock is undervalued by 35%. One reason for its massive discount may sit with its enormous debt burden of almost $10 billion, of which $2.6 billion is fixed-rate, and $7.3 billion is variable and based on the Secured Overnight Financing Rate (SOFR). Since SOFR is heavily influenced by the Fed Funds rate, changes to interest rate policy by the U.S. Federal Reserve is directly relevant to this stock. Management recently swapped $1 billion of its variable rate debt to hedge future rate increases, but the interest rate on its remaining SOFR-based debt is currently 6.66% to 6.91%, with this debt scheduled to mature in 2027 and 2029. For its most recent fiscal quarter ended March 31 (Q4, 2023), the company generated in excess of $300 million in cash flow from operations before paying out $80 million in quarterly dividends (currently yielding ~3% annually). Management stated that a hypothetical 100 basis point increase in SOFR would result in a $73 million increase in interest expense on an annualized basis—still manageable.

If you believe that the U.S. Federal Reserve is closer to the end of its hiking cycle than its beginning, you can reasonably expect SOFR is close to peak. Investors looking at GEN may give it a second look as the outlook softens for the SOFR which would boost GEN’s bottom line. On its May 11 2023 conference call for its fiscal 2023 year-end, management stated the following about its debt and EPS outlook:

“For the full-fiscal year 2024, we expect bookings growth in low-to-mid single-digits scaling through the year as we make progress on our key metrics. We remain focused on driving our long-term objectives and are still targeting to exit fiscal year '25 on a $3 annualized EPS with the following underlying key assumptions. Cyber safety business to grow mid-single-digits, post-synergy structure of 60% plus operating margin, free cash flow deployed towards debt paydown and share buyback, SOFR curve trends indicate rates below 3% exiting fiscal year 2025, diluted share count expected to be around pre-Avast merger levels.”

~GEN-NYSE, Q4 2023 Earnings Call

The fact that GEN reported on May 11 is relevant to my A.E. hypothesis. There was not a single mention of A.I. during the call (remember that Nvidia did not report its A.I.-enhanced outlook until two weeks later). My point here is that GEN is a good candidate for early-stage implementation of A.I.-based solutions, and that the stock does not seem to have been influenced by A.E. ….yet.

I’m a CFA charter holder and discretionary portfolio manager with over 15 years of experience in investment research and more than a decade serving on boards. I work best where integrity, insight, and long-term thinking matter.

In addition to portfolio management, I hold licenses to trade financial derivatives and offer life insurance solutions—allowing me to provide holistic, tax-aware guidance across a broad spectrum of client needs.